Why are mortgage interest rates rising?

So, what’s fueling the surge?

A few things.Rising inflation is one of the reasons. When inflation increases, the Federal Reserve takes action to help slow spending. In this case, the action the Fed took was raising interest rates.

When interest rates rise, there’s more incentive to keep money in accounts that accumulate interest than there is to spend on things that decrease in value. That leads to a drop in demand. When there’s less demand, prices stop spiking.

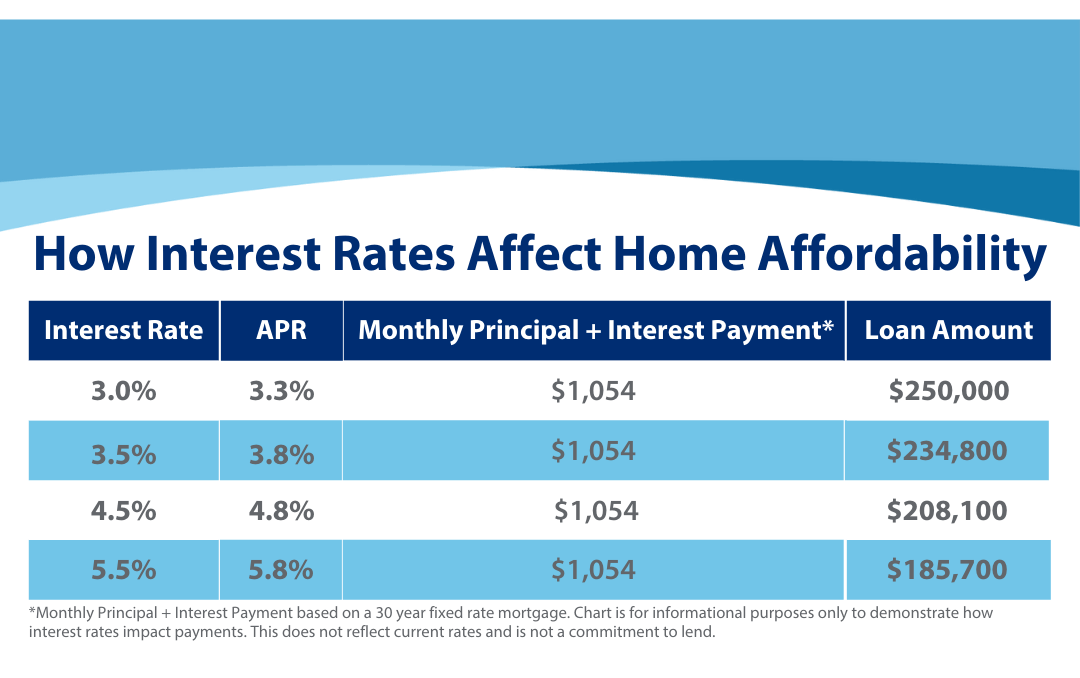

Higher interest rates also make things, like homes, less affordable because it gets more expensive to borrow money. Think of it this way—the more you have to pay towards interest, the less you can spend on the actual price of a home. The thought here is that increasing mortgage interest rates will slow down home appreciation and stabilize home prices—because buyers can’t afford as much, sellers won’t be able to sell at an inflated price. Those higher interest rates may also price some potential homebuyers out of the market, which lessens demand and will lead to a stabilization in home prices.

.png)

Another factor affecting interest rates is economic uncertainty due to Russia’s war on Ukraine. You may be wondering what a war on the other side of the world has to do with you. It’s a trickle-down effect. Sanctions have been placed on Russia as a result of the conflict in Ukraine. Those sanctions are affecting commodities—things like oil, gas, and wheat—along with our gas supply (you know what we’re talking about if you’ve filled up your tank recently).

Remember when we covered supply and demand? In this case, we’re talking about the effects of a limited supply and very strong demand. We don’t know what’s going to happen in Ukraine or when (or if) things will go back to normal. That means prices for the items Russia usually supplies to the world have skyrocketed. Rising interest rates should lead to a slow-down in the demand for the things we’re lacking due to the war, like gas.

How much higher will mortgage rates go?

Mortgage interest rates are expected to see 11 rate hikes through 2023. When we talk about rate hikes, we don’t just mean an increase in interest rate. A mortgage rate hike is equivalent to a .125% increase in rate. Nine of those 11 hikes are expected in 2022, including a 0.5% increase that happened in May and another 0.5% increase forecast for June.It is important to note that mortgage rates are forward looking. That means current mortgage interest rates reflect expected future rate hikes. In other words, the mortgage market is proactive, rather than reactive.

It makes sense when you think about how a mortgage works—it’s a long term loan. Basing the rate on what’s expected to happen ensures the lender makes a solid long-term investment when agreeing to finance a home.

The good news

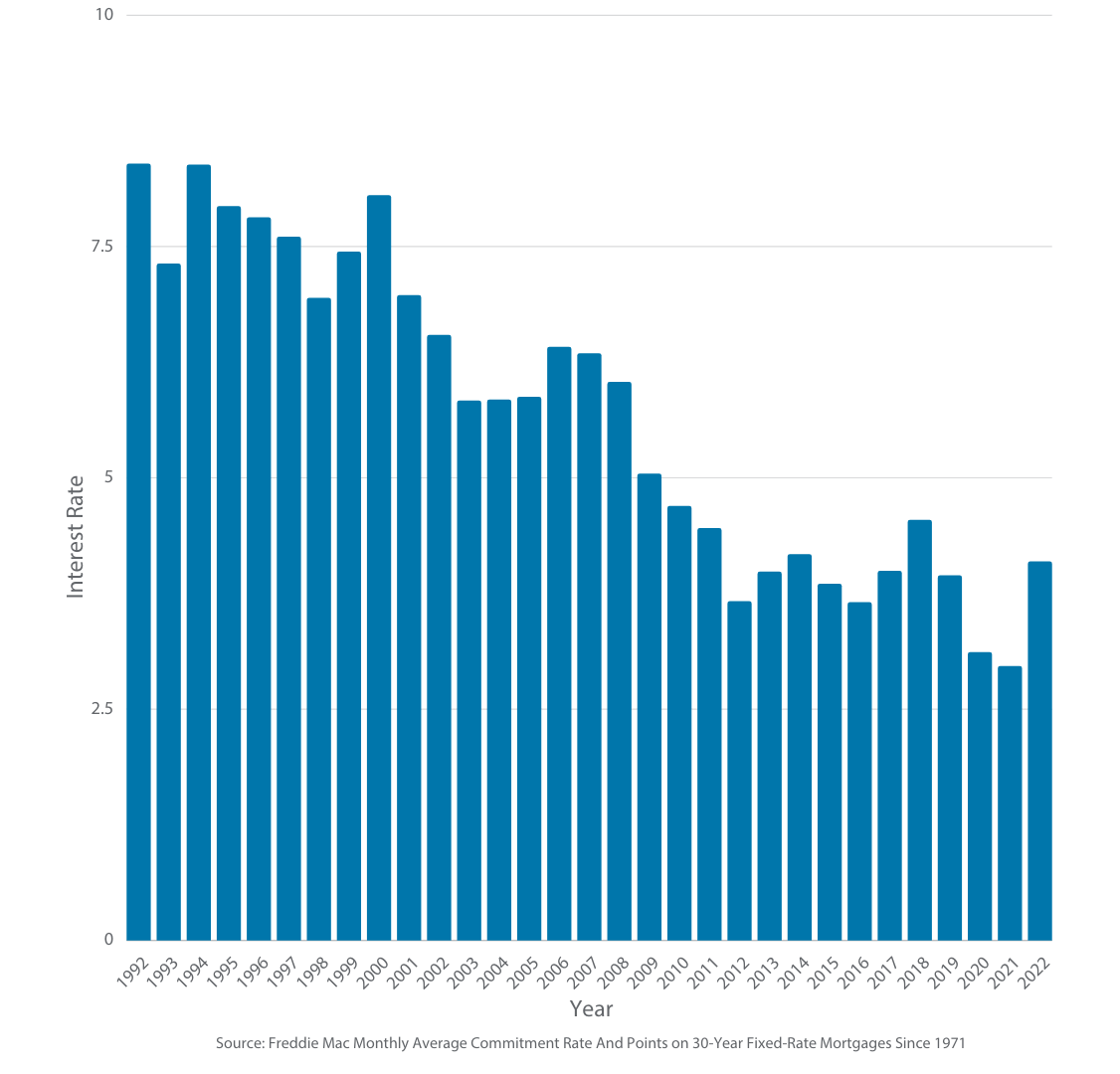

While mortgage rates have risen, they’re nowhere near where they have been historically. The increase feels significant because we’ve spent the last couple of years in an extremely low rate environment. But when you compare our current rates to historical ones, you can see we’re still in a really good place rate-wise.

Interest Rates Are Always Changing

If you’re thinking about buying a home or refinancing your current property you need to remember: mortgage interest rates don’t stand still. They’re always changing. And we’re not just talking about them changing day to day. The rate you’re quoted in the morning may not be the rate you can lock that afternoon—it all depends on what’s going on in the market and your unique financial situation.Our team of mortgage experts is here to talk through your home financing options. To get answers to your questions, call 1-800-914-8224 or connect with a mortgage loan originator now.