See how Click to Pay works for you.

Enroll your United Community Bank business debit card for an easy online shopping experience.

Enroll in Click to PayNo more reaching for your card.

No more forgotten passwords.

Check out online with peace of mind.

Encrypted payment information.

Sophisticated bot detection.

Protection against fraud.

Checking out with Click to Pay is as easy as 1, 2, 3.

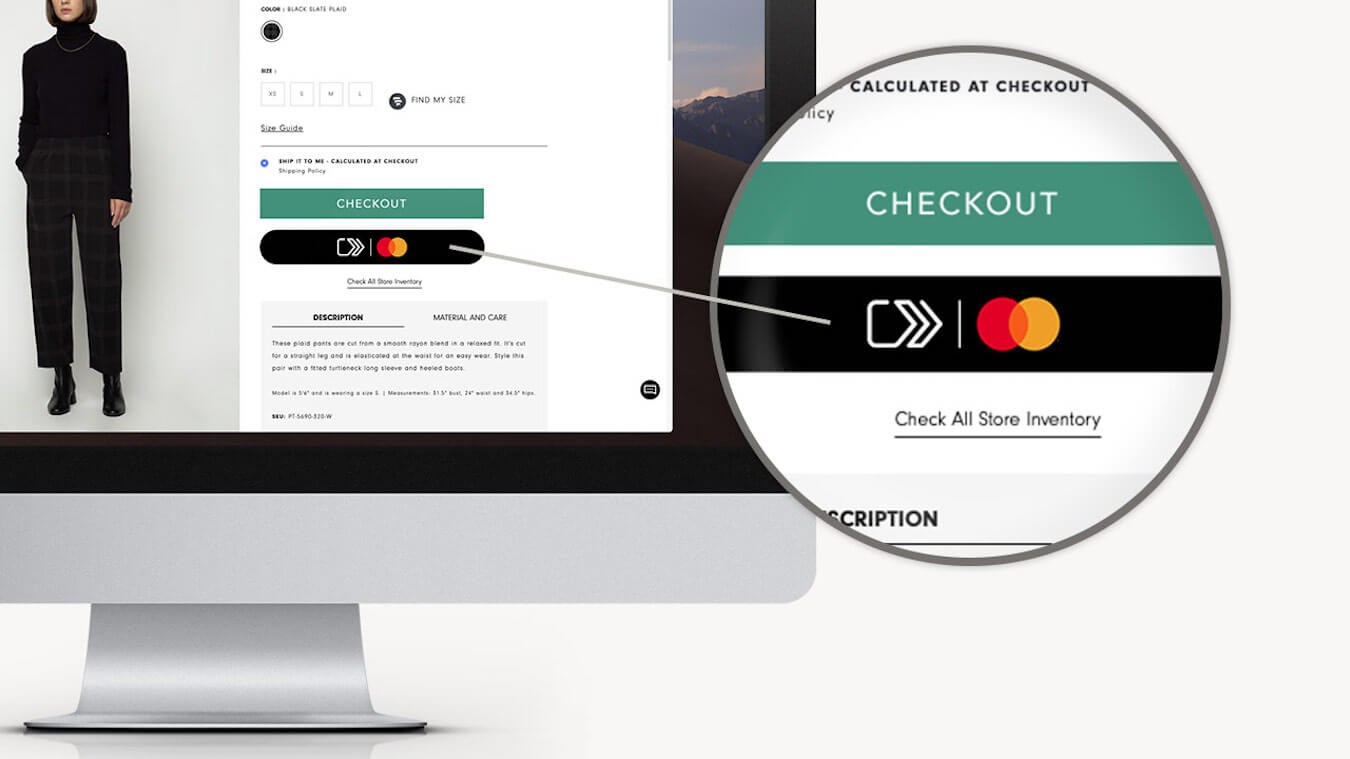

Step 1

Look for the Click to Pay icon at any participating merchant.

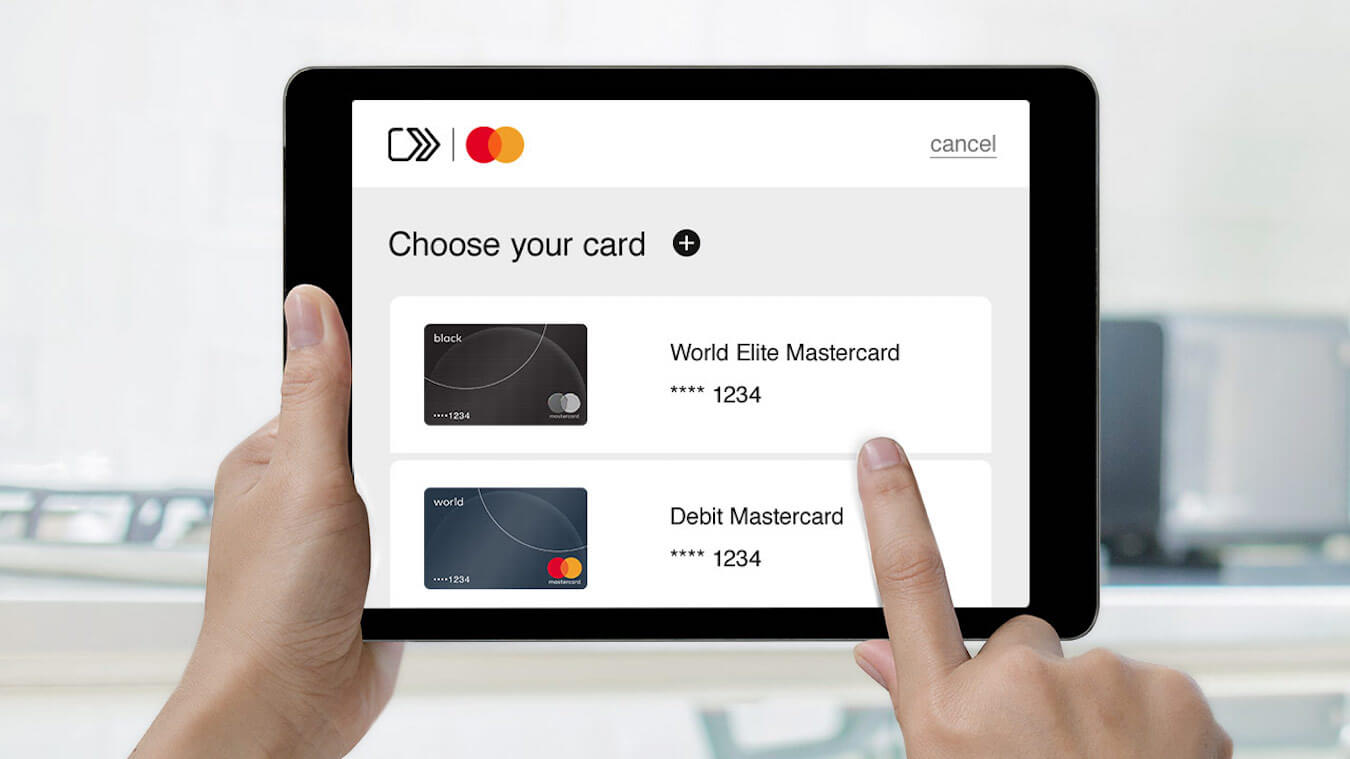

Step 2

Choose your saved United Community Mastercard® from a remembered device.

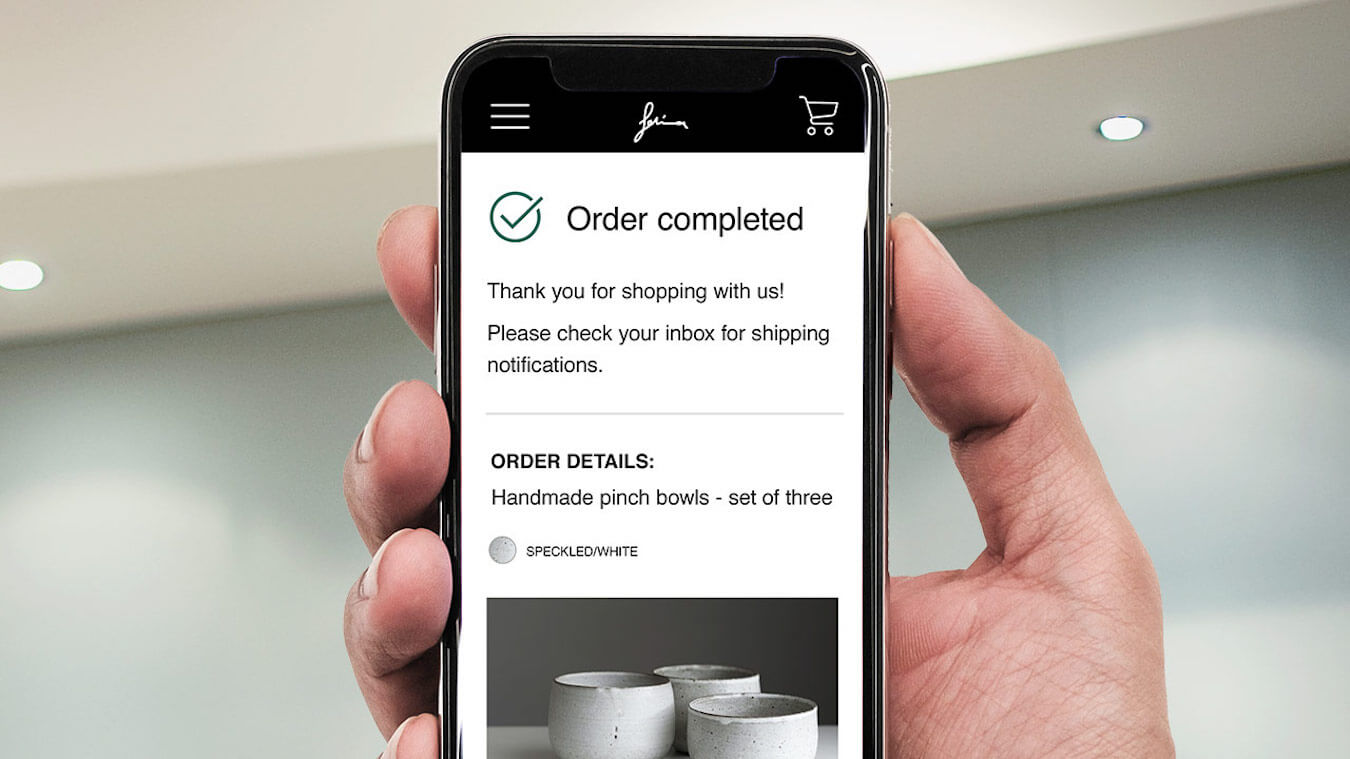

Step 3

Breeze through check out and get on your way.

-

Certain terms, conditions and exclusions apply. To learn more about Zero Liability, visit mastercard.com/zeroliability. Contact your issuing financial institution for complete coverage terms and conditions or call 1-800-MASTERCARD (1-800-627-8372) for assistance.

2 Certain terms, conditions and exclusions apply. Cardholders need to register for this service. This service is provided by Generali Global Assistance, Inc. Please see your guide to benefits for details or call 1-800-MASTERCARD (1-800-627-8372).

The Click to Pay icon is a trademark owned by and used with permission of EMVCo, LLC.