Health Savings Accounts

Access Your AccountUnited's HSA program transitioned to HSA Bank, a division of Webster Bank, N.A. (HSA Bank) on Friday, November 14, 2025. Please visit hsabank.com/united for additional information and a list of frequently asked questions.

United and HSA Bank are working together to ensure this transition is as smooth and seamless as possible for our existing, valued HSA customers. Please visit hsabank.com/United for additional information and a list of frequently asked questions.

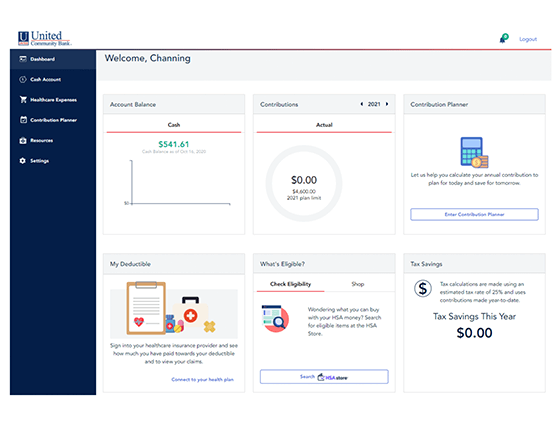

Your HSA Portal

Starting Monday, November 10, 2025, you will no longer be able to initiate reimbursement or contribution requests through United’s HSA Portal. You may begin using the HSA Bank Portal for these transactions. After the transition to HSA Bank you will have read-only access to your United HSA, including expense history, until Sunday, May 31, 2026. This allows you to view and save transaction history.

HSA Contributions

| Year | Individual/Single Coverage | Family Coverage (2+ Lives) | Catch-up Contributions2 |

|---|---|---|---|

|

Year

2024 Contributions

|

Individual/Single Coverage

$4,150

|

Family Coverage (2+ Lives)

$8,300

|

Catch-up Contributions2

$1,000

|

|

Year

2025 Contributions

|

Individual/Single Coverage

$4,300

|

Family Coverage (2+ Lives)

$8,550

|

Catch-up Contributions2

$1,000

|

-

To be eligible for an HSA account you must be enrolled in a High Deductible Health Plan (HDHP), cannot have additional healthcare coverage including Medicare or VA benefits and cannot be claimed as a dependent. HSA accounts cannot be rolled or transferred into any IRA account.

2Those age 55 and older may contribute an additional amount as shown as a catch-up contributor.