Economic Outlook

US Growth, Stickier Inflation, and a Slower Pace to Lower Rates

- US Economy on pace to grow 2–2.5% in Q1 of 2024

- Some deceleration still expected over this year

- Fed’s first rate cut expected at beginning of the summer

- Labor market remains strong

- Recession appearing less probable

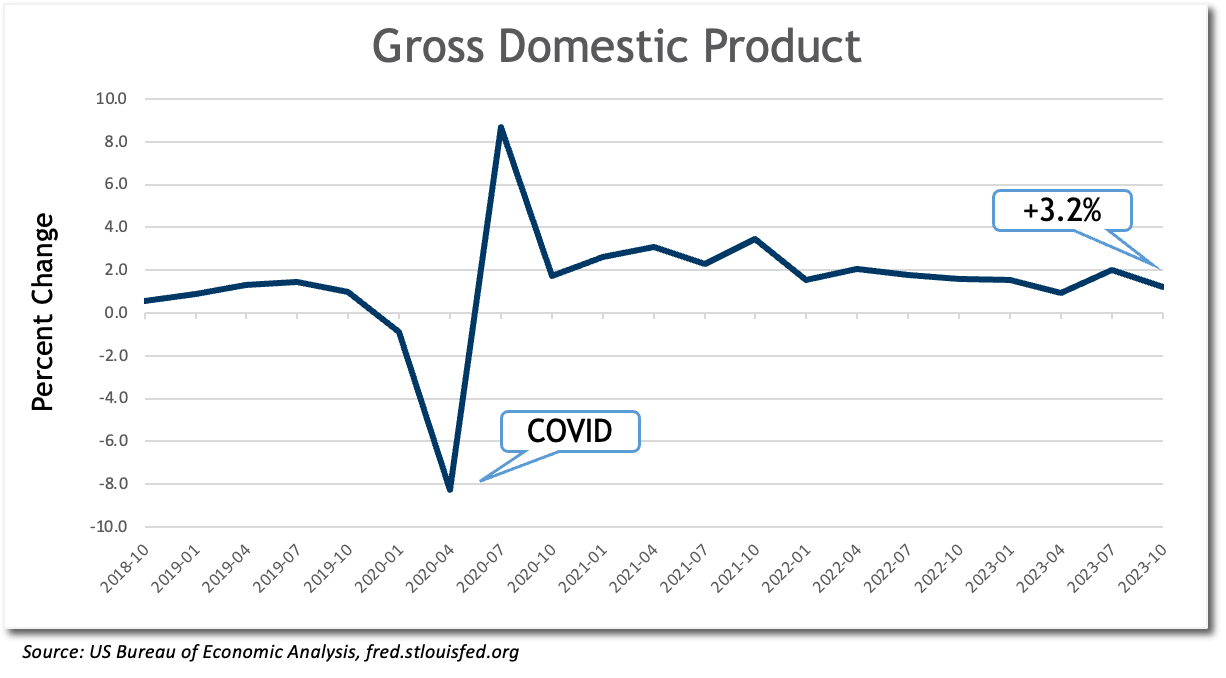

Growth

The US economy continues to surprise to the upside. Predictions of recession in 2024 are giving way to the realization that ours is presently the strongest of the large global economies. Momentum is on our side. Real GDP grew 3.2% in the fourth quarter of last year after posting growth of 4.9% in the third quarter. Although most analysts continue to forecast moderating growth for 2024, the first quarter of this year is widely expected to come in above a 2% annualized rate. The current expansion is occurring despite the sharpest increase in interest rates since the late 1970s. It has survived a simmering trade war with China as well as shooting wars in Ukraine and the Middle East. Supply chains broken by COVID have been substantially repaired, although shipping attacks by state-sponsored pirates remain a threat. The US trade balance has been improved by increasing exports of gas to Europe and Asia.

America’s economic performance is distinguishable from that of the other large economies. China is coping with a huge burden of real estate debt, a fraying relationship with its traditional trading partners, and a suddenly cautious domestic consumer. Real GDP expanded 5% in China last year, down substantially from 8.4% in 2021, according to the IMF. Europe seems perennially stuck in low gear—its economy exhibited trace growth in the second half of last year—and India, while growing impressively at 8.7%, has yet to attain its full potential.

Threats to US growth remain. The longer rates remain high, the greater the probability that they will yet trigger a recession. Economic history is full of examples of monetary policy overshooting its intended goals. The last few percentage points of inflation are proving to be stickier than the first, and rate cuts later this year could unleash pent-up demand that reverses some of the progress already achieved in that respect. Debt is approaching levels at the national, corporate, and household levels where its costs could smother further economic progress. As a nation, we grew increasingly comfortable carrying debt at historically low levels of interest. It is unlikely that we will return to those levels anytime soon.

Our domestic growth does not get universal respect. Consumer confidence is only marginally higher than what it was post-COVID. Real Personal Consumption Expenditures decreased fractionally in January, as a 0.4% increase in spending on services was offset by a 1.1% drop in spending on goods. The US consumer, the primary driver of the US economy, is displaying symptoms of strain. Total household debt rose to a record $17.5 trillion at the end of last year, and delinquencies have been increasing. Household debt is up 20% over the last three years, even as the cost of borrowing has soared. Personal interest payments are up 137% since December 2020. Total government spending increased 4.2% in Q4 of 2023, and state and local spending was up 5.4%. The Federal deficit is now equal to 8% of GDP. Deficit spending has helped support an expanding economy, but the US has never incurred this level of debt-fueled spending in peace time. Interest on the national debt is now the fastest growing part of the Federal budget. It is not sustainable.

Several key elements help explain the exceptional growth. America’s workforce has increased 4% since 2019. Foreign-born labor has increased by 4.4 million. While politically controversial, America’s ability to increase its labor force through immigration has given it an advantage over more insular economies. Demographic challenges threaten to constrain future growth in China, Europe, and Japan. America’s huge internal consumer market continues to be a reliable engine of growth and innovation. Although we still import more than we export, energy exports have tilted the balance of trade in our favor. All these advantages are vulnerable to proposed changes in public policy. Both ends of the political spectrum have proposed policies that could damage one or more of these drivers of growth, and the healthy bounds of debt and deficit spending were passed some time ago. We anticipate continued but slowing growth for the US economy over the balance of 2024.

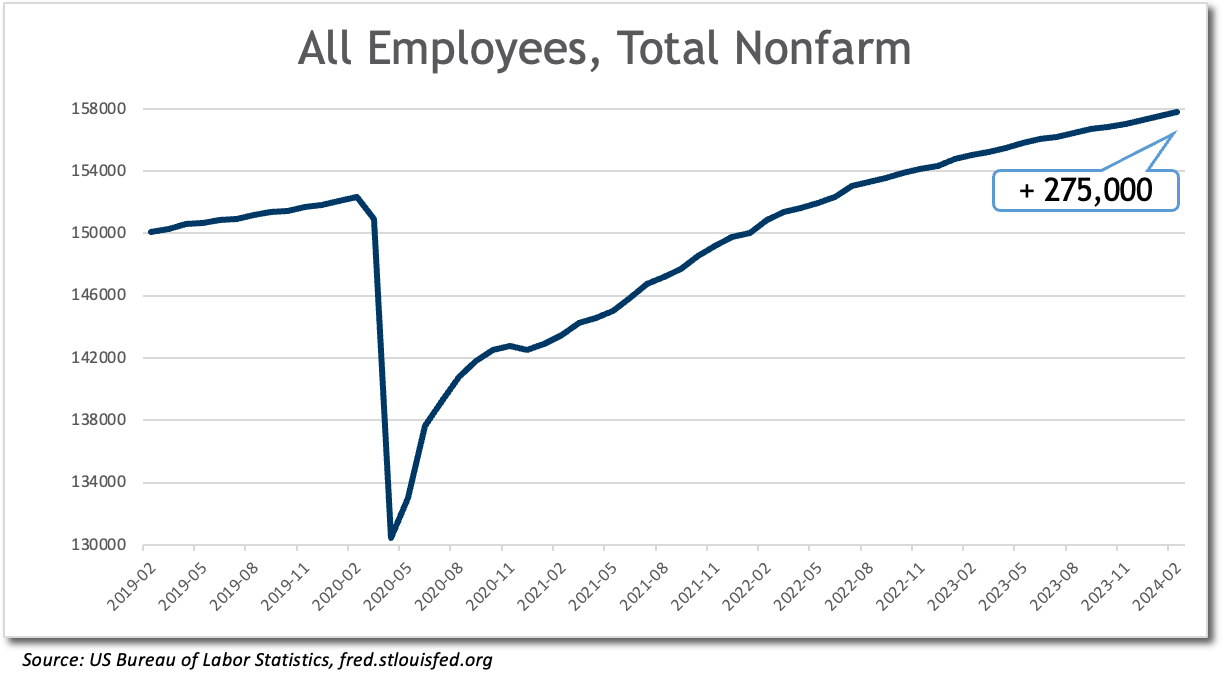

Employment

- 275,000 jobs added in February

- Unemployment rose to 3.9%

Payrolls increased by a strong 275,000 in February, yet unemployment also rose to 3.9%. The unemployment rate was 3.6% one year ago. The number of unemployed rose to 6.5 million; one year ago, it stood at 6.0 million. US employment remains strong but is softening when compared to its strongest post-COVID performance. Although prior months’ gains were revised downward, the average monthly gain for the past three months is still over 250,000 jobs. Job gains were widespread across industries. Demand for temporary help has been declining for almost two years, and additions of part-time jobs are outpacing full-time employment. The ranks of the longer-term and permanently unemployed are increasing, and wage growth is beginning to slow. Job openings continue to decline and are now 16% below their number one year ago. A gradual softening of the labor market could reduce wage inflation and support the case for interest rate cuts by the Fed later this year.

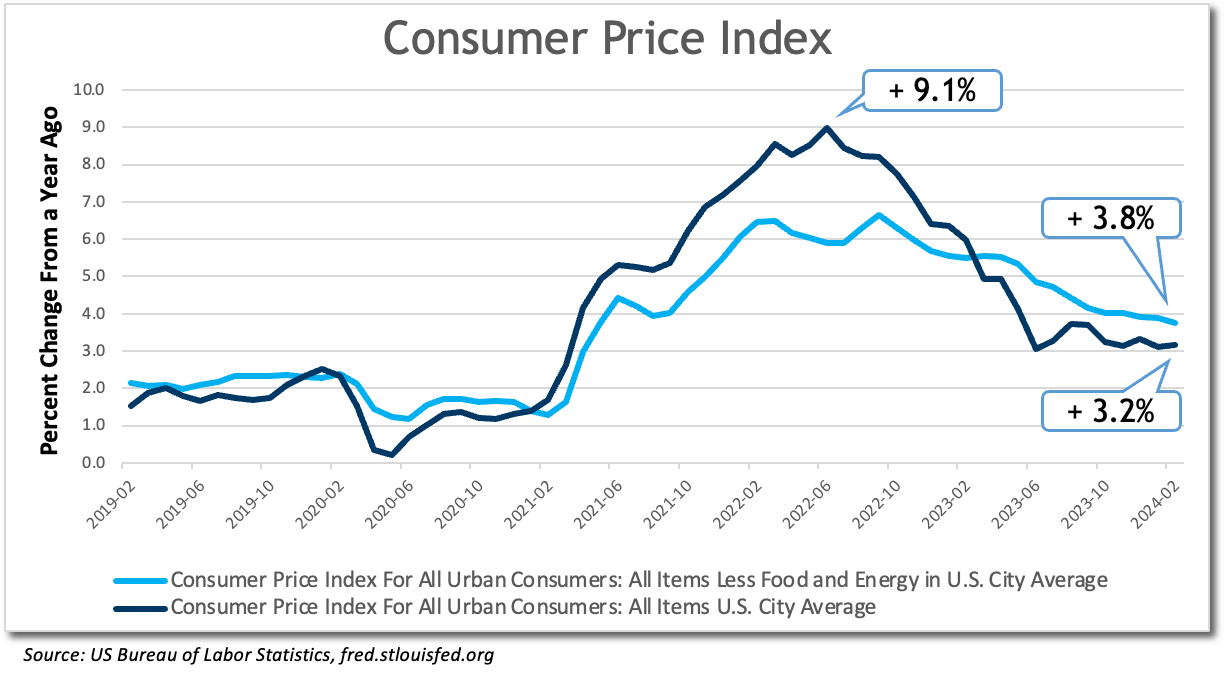

Inflation

- Inflation proving to be “sticky” at this level

- “All items” CPI up 3.2% in February

- Core CPI at 3.8% and still trending down

- Road down to 2% proving tougher than anticipated

The “all items” CPI index came in at 3.2% for the 12 months ending in February. Inflation remains substantially above the Fed’s target rate of 2%. The most recent report was a reminder that the problem of rising prices may not be as easily or quickly resolved as many had hoped. In this broad index, sixty percent of the monthly increase in price levels was in gasoline and housing. The broad index has not found a new low since last summer. The “core” index (all items less food and energy) was up 3.8% but continues to show gradual improvement. Inflation is proving to be a bit stickier than expected here. The last few percentage points may be tougher to quell than had been estimated earlier this year. The overall picture is one of gradual improvement, but nothing in this report would cause the Fed to accelerate its plans to cut interest rates.

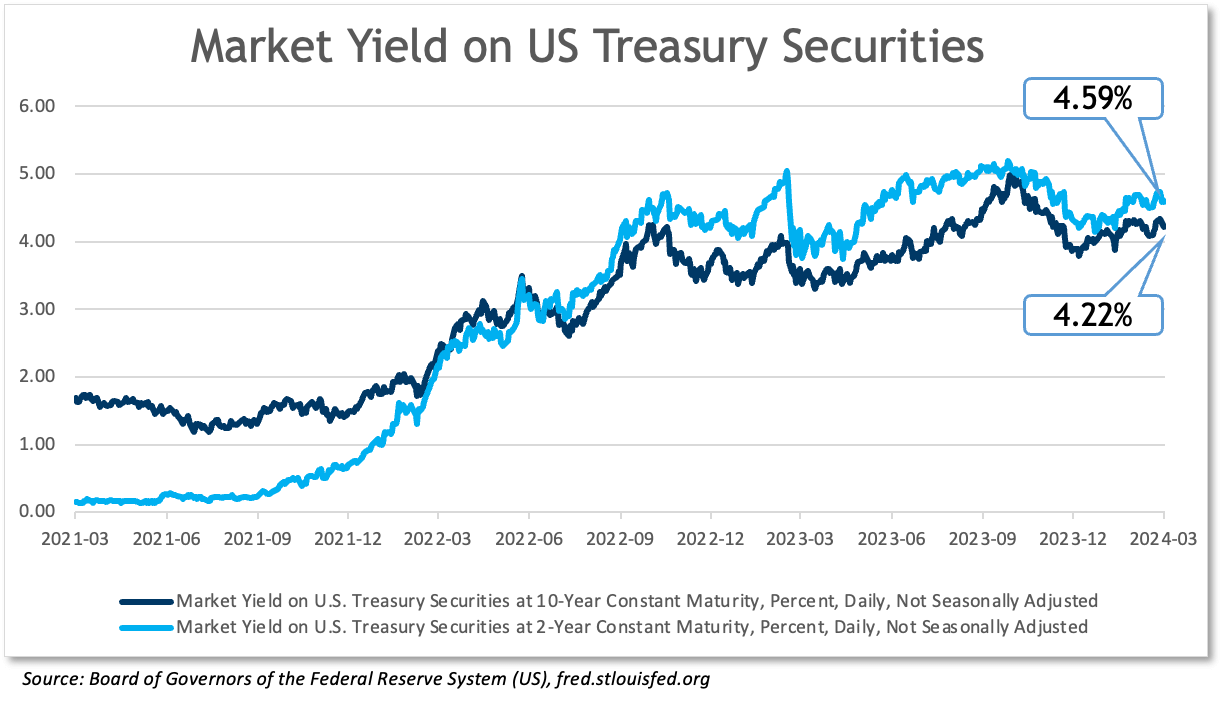

Interest Rates

- Fed rate increases are behind us

- First rate cut anticipated at the beginning of the summer

- Fed balance sheet contraction expected to slow

The Fed Open Market Committee met on March 19th and 20th. They will meet May 1, June 12, and July 31 before their summer break. At one of these future meetings and prior to this summer, they are expected to begin the process of cutting interest rates. Most observers believe they will use the June meeting to announce the first cut. Typically, once the Fed embarks on a course of rate cuts, they continue that process with more cuts until they see evidence of the intended impact on employment, or the economy arrives at a “neutral rate” of interest. The neutral rate is that level of interest which is neither inflationary nor constricting to growth. It is difficult to pinpoint in advance. The “dot plots” released at their last meeting suggest that this target rate is estimated to be 2.5-3.1%. The upper bound of the current Fed Funds target is 5.5%. At the most recent meeting, the median estimate for the Fed Funds rate by FOMC participants was 4.6% for year-end 2024, implying as many as four rate cuts this year. There are reasons to believe that the Fed will be cautious with rate cuts once they begin. First, its inflation objective of 2% has not yet been achieved. Second, any cuts could unleash some pent-up demand, thereby making further progress on inflation more difficult, and finally, the economy is doing surprisingly well at current, elevated rates of interest.

The Fed is presently allowing $95 billion of assets to “run off” every month. They do this by allowing a portion of their currently held bonds to mature without rolling proceeds back into Treasuries. This has the effect of draining the amount of cash available to the financial system. It is widely expected that the Fed will begin to reduce the amount of “runoff” soon. The anticipated new monthly target will be about $50 billion. They may start this process as soon as their next meeting.

Markets

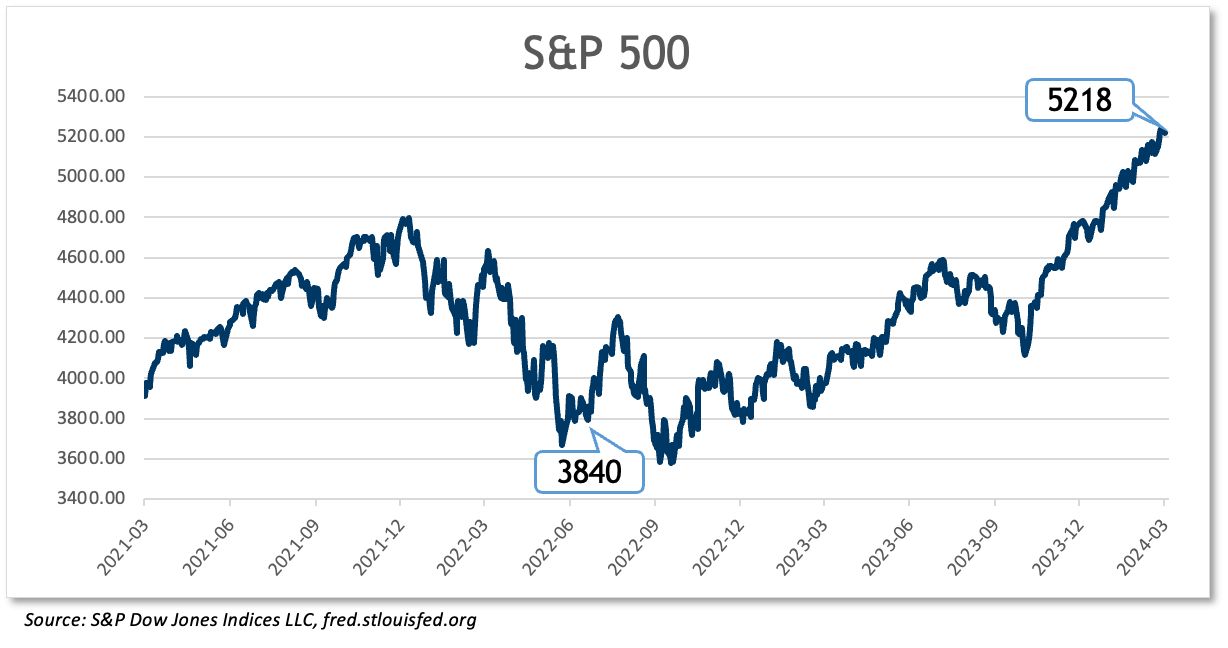

- S&P 500 reaches new highs – again

- Bond market anticipating lower rates

The S&P 500 continues to reach new highs in 2024. It is up over 10% so far in 2024, after an impressive 24% run-up in 2023. Momentum and excitement over the possibilities for Artificial Intelligence (AI) are driving the market higher. Corporate earnings were up 4% in the final quarter of 2023 and are expected to rise 3.4% in the first quarter of 2024. Many analysts are forecasting overall earnings growth of 10% in 2024. Even if achieved, such earnings will not be evenly distributed—much of the gains are being concentrated in the high-tech industries. Even so, those industries are surprisingly dominant drivers of market performance. Over 60% of the S&P 500’s gains in 2023 came from the “magnificent seven” stocks (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla). This year, they only account for 40 percent of the index’s gain, and there has been much greater divergence in their moves. Nvidia is up 90% and Microsoft is up 14%, however Apple is down 11% and Tesla is down 31%.

At these levels, stocks are very expensive. The S&P 500 currently trades at over 28 times its annual earnings level. This compares to a long-term average of 16 times earnings. Valuation tells us nothing about timing, but one must wonder how much room stocks have for further expansion of the earnings multiple.

The yield curve for Treasuries remains deeply inverted. At this writing, the overnight rate is 5.3%, the two-year rate is 4.49%, and the ten-year is 4.22%. This has been one of the longest periods in US history that the yield curve has remained inverted.

If we can help or provide additional information; please do not hesitate to contact us.

Learn about our economy expert.

-

This information is for informational purposes only and does not constitute investment advice.

Sources:

GDP – Bureau of Economic Analysis

Employment & Inflation – Bureau of Labor Statistics

Interest Rates – Federal Reserve

P/E S&P 500 – multpl.com

Non-Deposit investment products and services, and Insurance products and services offered through United Community Banks, Inc. are:• NOT Insured by FDIC or Any Other Government Agency;

• NOT Guaranteed by United Community Bank or any affiliate of United Community Bank;

• NOT a Deposit or Obligation;

• Subject to Risk and May Lose Value

This content is not intended as, and shall not be understood or construed as, financial advice, investment advice, or any other advice. This content is provided for informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. United Community shall not be liable for any damages of any kind relating to such information not as to the legal, regulatory, financial or tax implications of the matters referred herein. All views and opinions expressed are those of the writer/commentator and do not reflect the views or positions of United Community.