Economic Outlook

Resilience in the Markets; Headwinds in the News

- War and tariffs dominate headlines

- US growth slowing, but still positive

- High interest rates held up by deficit spending

- Inflation showing slight improvement

- Tariff price impact still to come

Growth

- US real GDP contracted in Q1, set to expand in Q2

- Imports are main reason for headline GDP results

- Sales indicate continuing growth at a slower rate than in 2024

- Personal income is strong; consumer spending slowing slightly

According to the headline numbers, US Real GDP shrank in the first quarter of 2025. The entire reason for that shrinkage was a “frontloading” of imports made in anticipation of proposed tariffs. “Net Exports”–total exports minus total imports–are part of the calculation of US GDP. Because the US typically runs a trade deficit with the rest of the world, our trade deficit will cause a reduction in GDP in most calendar quarters. In most quarters that reduction is not nearly enough to make the overall number negative. However, in the first quarter of 2025 our trade deficit ballooned 56% because of importers scrambling to beat the new tariffs. Because so much of the demand for imports was pulled forward to Q1, the same forces that caused a contraction in GDP in Q1 will almost certainly cause an increase in GDP in Q2. Our trade deficit fell 55% from March to April of 2025. In addition, much of the items imported in the first quarter probably went into inventories, and increases in inventories are an addition to the overall calculation of GDP.

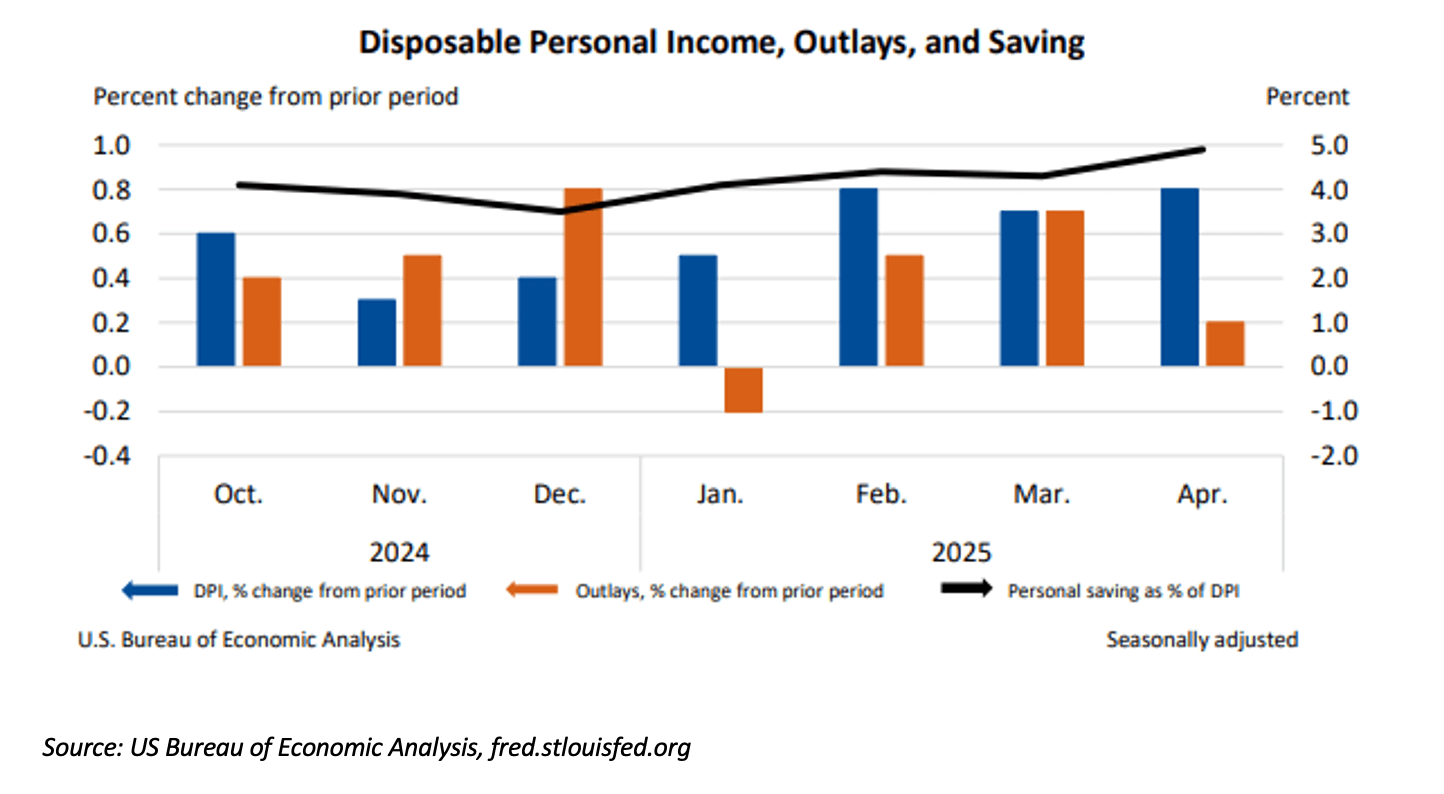

None of this is very intuitive and, in the present circumstances, these factors in the calculation of GDP may not be the best indicators of the overall health of the US economy. Two other measures, Disposable Personal Income and Personal Consumption Expenditures–spending–may provide us with better insights into current growth. Disposable Personal Income was up 2.9% in April, the largest monthly increase of the last eight months. A large part of that increase was the result of Social Security benefits having been expanded for retired Federal and State employees also covered by pensions. Personal Consumption Expenditures increased 2.1% in April, the lowest increase since last September. The difference between those two numbers helps explain the rise in the personal savings rate to 4.9% in the month of April.

Taken together, the data on personal income and spending draws a picture of an economy that continues to grow, but at a slower pace than in 2024. GDP almost certainly understated growth in the first quarter of 2025, and it will probably overstate growth in the second quarter. While various factions in Washington will claim credit for the improvement, a more balanced view will provide a clearer insight into the direction of growth. By most measures, the US economy grew in the first quarter and continues to grow into the second, however, it is doing so at a slower pace than in 2024.

Employment

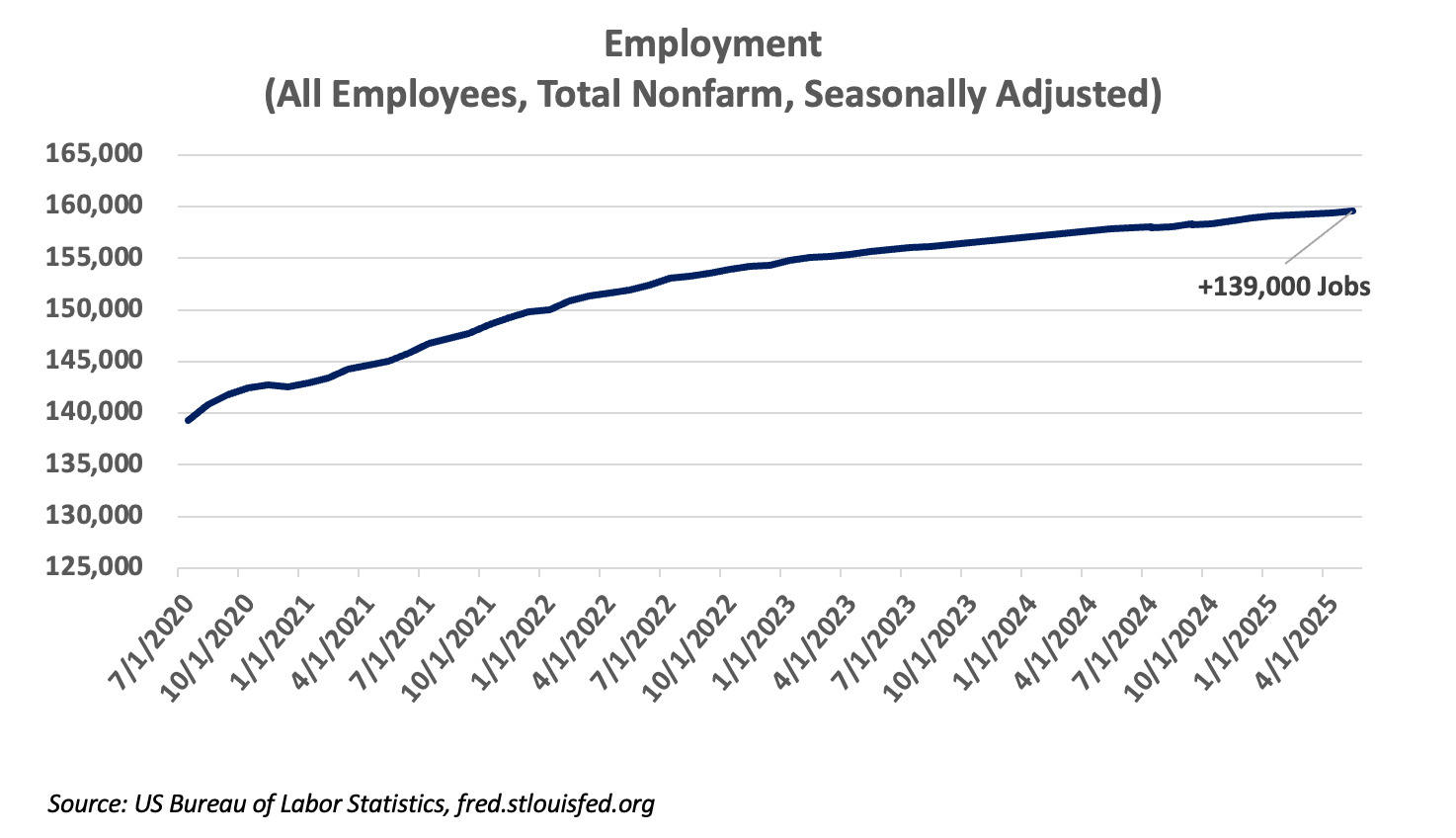

- Payrolls increased 139,000 in May

- Unemployment held flat at 4.2%

- Wage increases continue to be moderate

The US economy added a moderate 139,000 jobs in May. Unemployment has gradually moved up from 3.4% from two years ago but remains low at 4.2%. Wage increases have held to a level that should not contribute very meaningfully to inflation. Reported job openings have declined to 7.4 million, only slightly higher than the number of unemployed workers. Job openings were over 11 million in early 2022. With respect to employment, any evidence of a slowdown is showing up primarily in the lower number of open positions, rather than in the number of unemployed.

Inflation

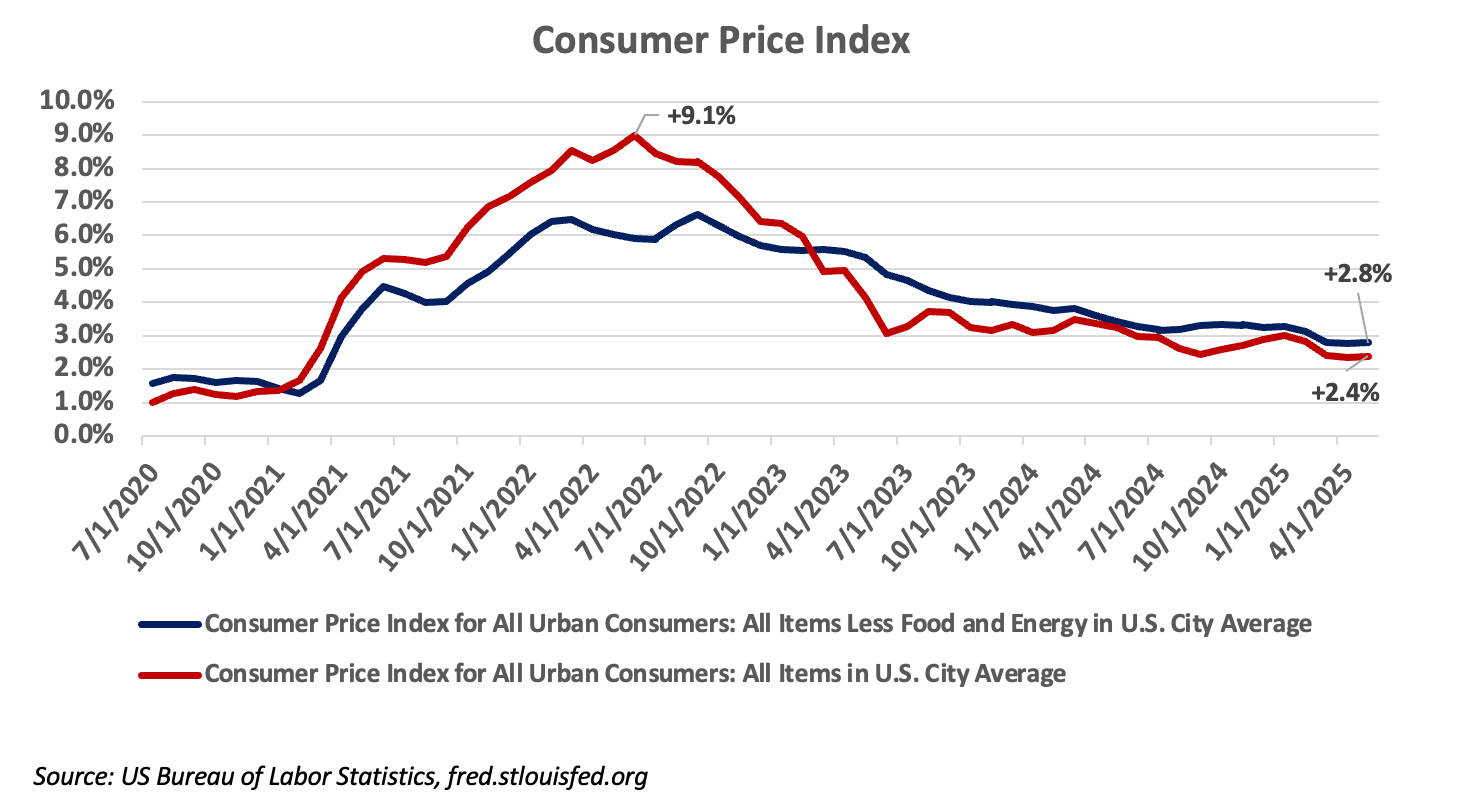

- May CPI held at 2.4%

- Core CPI was also flat at 2.8%

- Inflation improving, but still above 2%

For the 12 months ending in May, CPI inflation was 2.4%. Declines in the price of gasoline helped lower the inflation rate, however, natural gas and electricity were up. Housing continues to make an outsized contribution to inflation, while food inflation has moderated. Air fares have come down over the past year with declines in energy, however, war in the Middle East may limit further progress on energy inflation. Improvements in inflation are occurring at a slower rate and the overall rate of inflation remains above the Fed’s 2% target. Tariffs, which will add to the cost of many goods, are not yet reflected in the inflation rate. The consumer’s perception of inflation remains elevated because prices remain elevated. Inflation is a measure of the rate of change in prices, not the overall level of prices.

Interest Rates

- Federal Reserve faces a very tough dilemma

- Short-term target rate held at 4.25%–4.50%

- Key 10-year Treasury rate at 4.44%

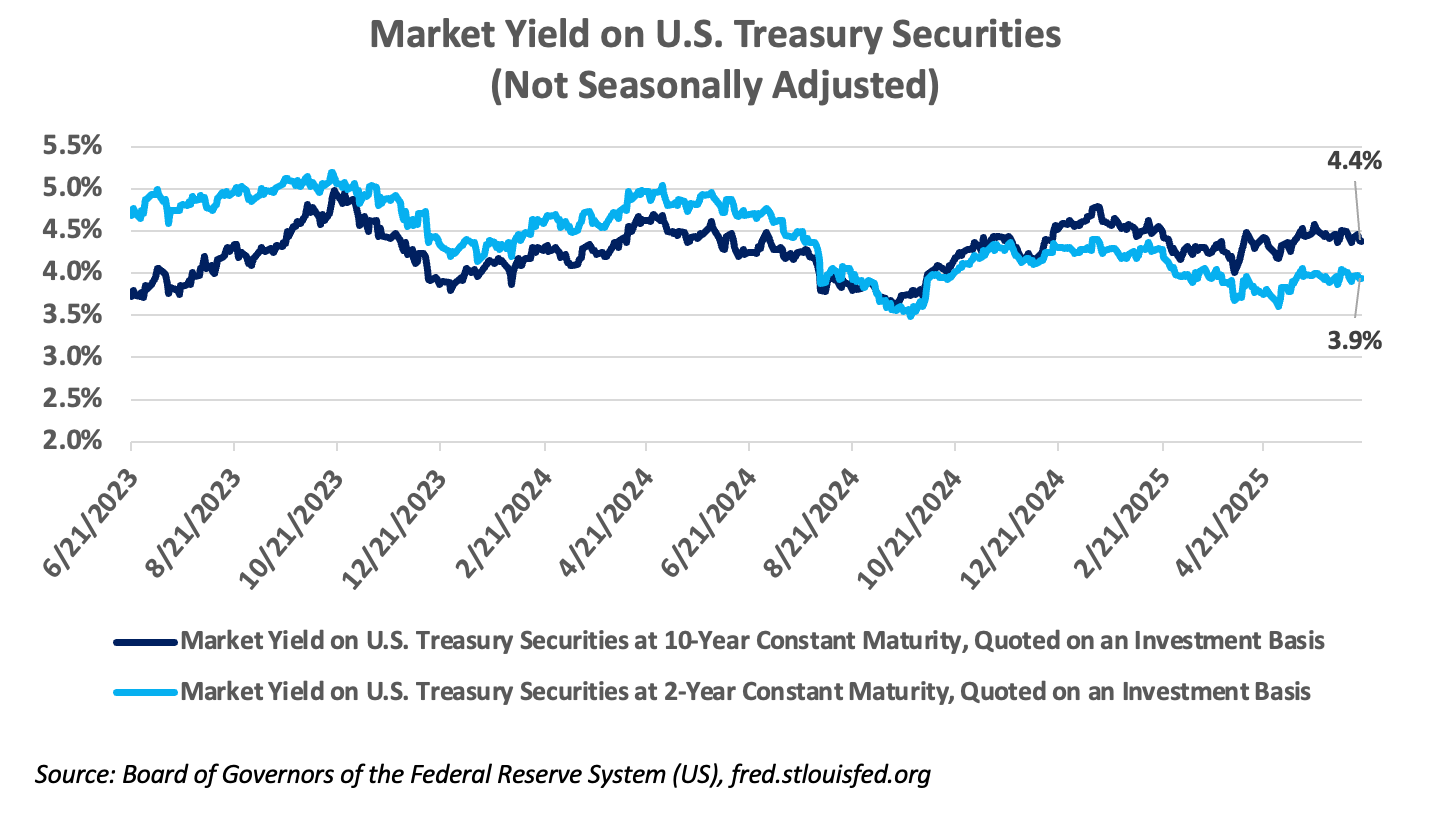

The Federal Reserve’s Open Market Committee met on June 17 and 18. As expected, they left their target for short-term rates unchanged, as they did at their previous meeting. Political pressure is mounting for a rate cut; however, the futures market is indicating that the first cut will probably come no sooner than the September meeting. Political pressure is almost always in favor of lower rates. We cannot recall any President ever arguing for higher rates, even during periods of high inflation.

With the economy slowing down and inflation still above their target of 2%, the Fed is facing a very tough dilemma. Cut rates too soon and inflation may stop improving or even turn up, especially if tariffs contribute significantly to the cost of goods. If they wait too long, the economy may stall or even fall into recession. The labor market continues to be solid, so unemployment is not forcing their hand at current levels. Most projections, and the bond market itself, are indicating that we will still get two rate cuts by the end of 2025. While some short-term rates, notably the three-year Treasury, are lower, the 10-year Treasury remains above 4.3%. A great deal of longer-term credit rates, such as 30-year fixed mortgages, are priced off the 10-year Treasury yield. Under most circumstances, the Federal Reserve has very little influence over intermediate term rates, such as the 10-year Treasury yield. The persistence of high yields on intermediate term bonds, can be attributed to the pace of government borrowing. That borrowing is, in turn, pushed up by continued deficit spending. The “Big Beautiful Bill” working its way through Congress does nothing to reduce the pace of government borrowing.

Markets

- Stocks sell off then recover on news of war

- International stocks outperforming US

- Bonds earning yields above inflation rate

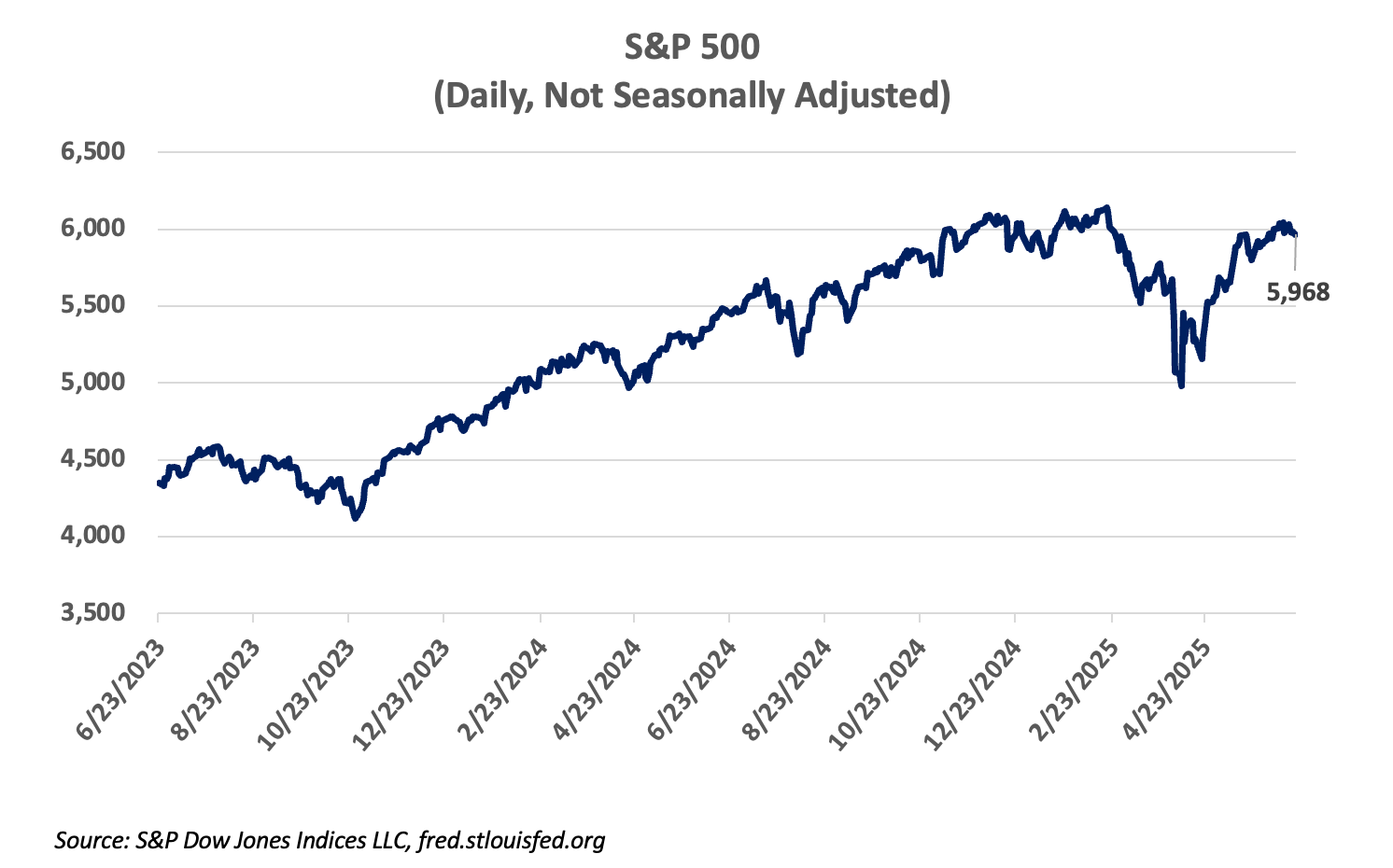

Stocks sold off following the beginning of hostilities between Israel and Iran but quickly bounced back and have traded in a range for most of this month. This selloff was much shallower and more short-lived than the selloff following the announcement of tariffs on April 2. At this writing, the S&P 500 is trading at about 5966 and is up just over 1% so far this year. It has experienced a lot of volatility for such a lack of direction. International stock indexes, which have trailed their US equivalents for the last several years, have outperformed domestic stock indexes in this volatile environment. The MSCI World index is up 5.9% YTD and Euro Stoxx 50 is up 6.9% YTD. Investors seeking diversification may want to consider exposure to international stocks.

The US dollar has lost ground against most major currencies; the US currency is down over 9% YTD compared to a basket of major foreign currencies. The dollar decline reflects tariff turmoil, excessive federal debt and the loss of America’s last AAA credit rating. Today, more international companies are asking for payment in currencies other than US dollars, something rarely seen since WWII.

Real interest rates on bonds–the yield above the rate of inflation–are at highs that have not been seen since 2007. Investors seeking preservation of capital can earn interest at rates above the pace of inflation, a condition not seen in the ultra-low rate environments following the financial crisis and COVID. Surprisingly, US Treasuries did not benefit substantially from the outbreak of war, signaling that US debt is no longer the automatic safe-haven it has been during past geopolitical crises. Yields on the 10yr-Treasury bond have declined 8 basis points (0.08%) since this time last month and now stand at 4.38%.

If we can help you navigate this changing business climate, please do not hesitate to contact your United Community banker. We appreciate your readership.

Learn about our economy expert.

-

This information is for informational purposes only and does not constitute investment advice.

Sources:

GDP – U.S. Bureau of Economic Analysis via FRED®

Employment & Inflation – U.S. Bureau of Labor Statistics via FRED®

Interest Rates – Board of Governors of the Federal Reserve System (US) via FRED®

S&P 500 – S&P Dow Jones Indices LLC via FRED ®

Market data – YCharts

Non-Deposit investment products and services, and Insurance products and services offered through United

Community Insurance, an independent insurance agency, are:- NOT Insured by FDIC or Any Other Government Agency;

- NOT Guaranteed by United Community Bank or any affiliate of United Community Bank;

- NOT a Deposit or Obligation;

- Subject to Risk and May Lose Value

This content is not intended as, and shall not be understood or construed as, financial advice, investment advice, or any other advice. This content is provided for informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. United Community Bank shall not be liable for any damages of any kind relating to such information not as to the legal, regulatory, financial or tax implications of the matters referred herein. All views and opinions expressed are those of the writer/commentator and do not reflect the views or positions of United Community Bank. United Community Bank provides investment, administrative, and trustee services to customers of United Community Bank