United Community Celebrates National Teach Children to Save Day by Empowering Children with Financial Literacy

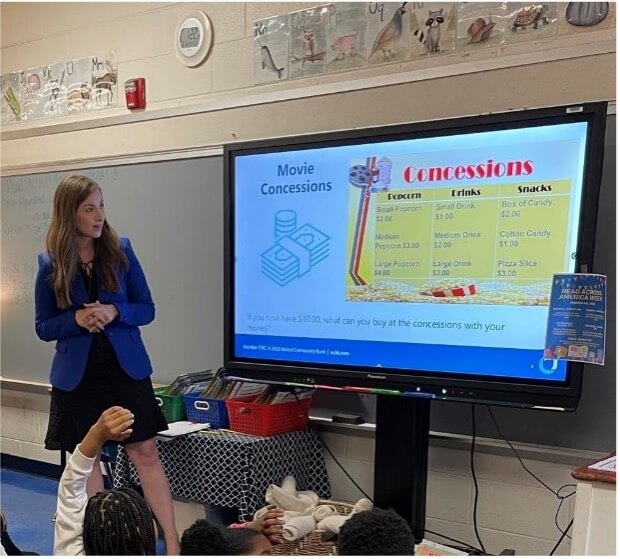

Throughout April, United employees will visit local schools to read "The Four Money Bears" to children. This engaging story teaches kids the basics of money management – saving, spending, sharing, and investing

“Financial literacy helps people make informed decisions,” said Moryah Jackson, SVP, director of community development and engagement at United. “Our bankers want to empower more people to make informed and responsible decisions about their money.”

Additionally, the United Community Bank Foundation is investing in the future by donating a total of $30,000 to organizations across the Southeast dedicated to teaching personal finance including:

- Alabama: Habitat for Humanity of Morgan County, Eastern Shore Chamber Foundation Student Training & Exploration Program, Vestavia Hills Library Foundation and Junior Achievement of Tuscaloosa County.

- Florida: The Lucy Project Inc and 8 Cents in a Jar. • Georgia: Sweetwater Mission, Nicholas House, Boys and Girls Club of Southeast Georgia, Isaiah House, Ferst Readers and Family Promise of Hall County.

- North Carolina: Big Brothers Big Sisters of Western North Carolina, Hope House Foundation, Hearts United for Good, Smart Start of Mecklenburg County and Cape Fear Literacy Council.

- South Carolina: C4-Easley, SC Thrive, Educate Our Youth, The Mamie Keith and Allene Bradley Foundation, Hope Center for Children and SC Career Kids.

- Tennessee: Nashville Safe Haven Family Shelter and Iva’s Place.

About United Community Banks, Inc.

United Community Banks, Inc. (NASDAQ: UCBI) is the financial holding company for United Community, a top 100 US financial institution that is committed to improving the financial health and well-being of its customers and the communities it serves. United Community provides a full range of banking, wealth management, and mortgage services. As of December 31, 2023, United Community had $27.2 billion in assets and 207 offices across Alabama, Florida, Georgia, North Carolina, South Carolina, and Tennessee, as well as a national SBA lending franchise and a national equipment financing subsidiary. In 2024, United Community became a 10-time winner of J.D. Power’s award for the best customer satisfaction among consumer banks in the Southeast region and was recognized as the most trusted bank in the Southeast. In 2023, United was named by American Banker as one of the "Best Banks to Work For" for the seventh consecutive year and was recognized in the Greenwich Excellence and Best Brand Awards, receiving 15 awards that included national honors for overall satisfaction in small business banking and middle market banking. Forbes has also consistently listed United Community as one of the World’s Best Banks and one of America’s Best Banks. Additional information about United Community can be found at ucbi.com.