Card Controls

Card Controls Features

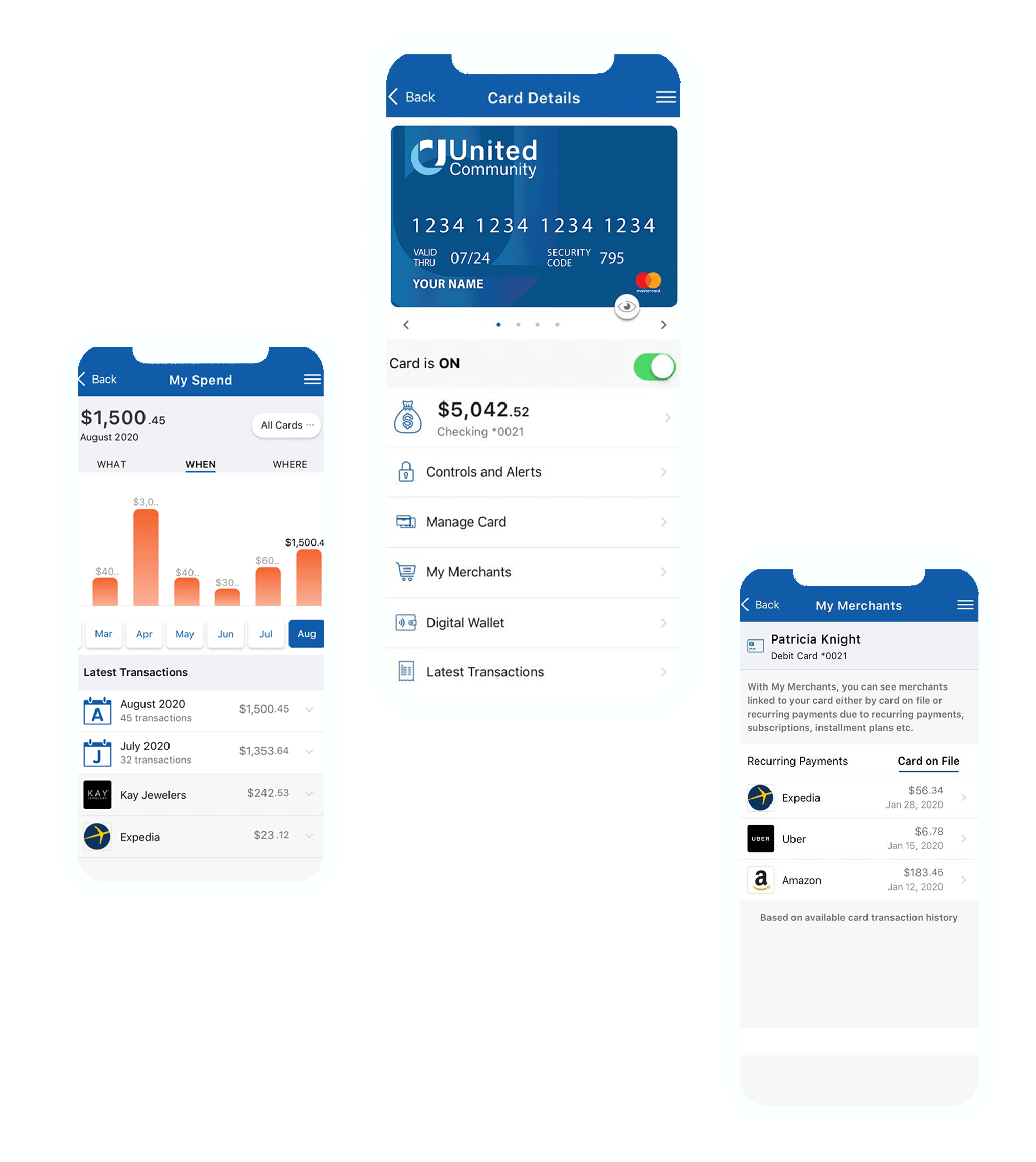

Digital Wallet

Card on File

Recurring Payments

Spending Insights

Merchant Details

Learn How to Use Card Controls

Frequently Asked Questions

- Manage cards on the go with advanced controls and self-service options.

- Understand your spending clearly with quick spending insights, recurring payment information, ‘card-on-file’ merchant identification, and transactions that easily let you see the merchant’s name, logo, interactive maps, and contact information.

- Get real-time transaction alerts so you know exactly when and where your card is being used.

- View a digital card on a mobile device and easily push it to Apple Pay® and Google Pay™.

View this demo to get started!