How Homeownership Could Amplify Your Net Worth

Key Takeaways:

- Homeownership can be a powerful wealth builder. Homeowners have a net worth 40 times greater than renters.

- Mortgage payments generate the asset of home equity; rent payments are just a liability, or cost.

- Home equity grows over time as you pay down the principal you owe and your home appreciates in value.

The net worth of US homeowners is 40 times more than renters. That’s according to a 2019 Federal Reserve study. It found renters had a net worth of just $6,300, versus $255,000 for homeowners.

What’s net worth?

To fully grasp those numbers, you need to understand what we mean by “net worth.” That term refers to the things you own that have a monetary value (assets) minus what you owe (liabilities).

So, for example, if you own your car, it’s an asset and adds to your net worth. But if you’re leasing that vehicle, it’s a liability and is going to lower your net worth.

Homeownership has the same effect. When you own where you live, it becomes an asset. When you don’t, it’s a liability.

What’s driving the net worth gap?

The key factor driving up net worth for homeowners is those monthly mortgage payments. Think of it this way—whether you rent or buy, you’re going to make a monthly housing payment.

The difference when it comes to being a homeowner is that you get a return on that monthly expense. Those mortgage payments turn into home equity¾as you pay down your mortgage, your home equity rises.

What’s home equity?

Home equity describes how much of the home you own versus how much you owe your lender.

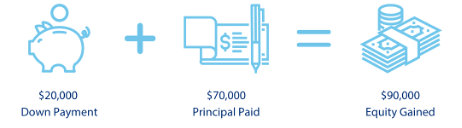

For example, if you purchase a home for $300,000 and make a down payment of $20,000, your mortgage loan amount would be $280,000. That $20,000 down payment turns into home equity.

If, after 10 years, you’ve paid back $70,000 of the $280,000 you borrowed, you’d have $90,000 in equity (the $70,000 you’ve repaid, plus that $20,000 down payment).

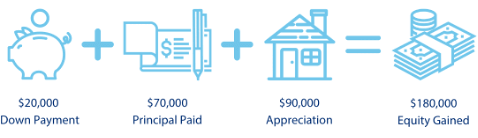

But you also have to factor in home appreciation¾that’s the increase in your home’s value over time. So let’s say you’ve owned your home for 10 years and instead of the $300,000 you originally paid, it’s now valued at $390,000. You would have actually gained $180,000 in equity over the decade you’ve owned the home (the $90,000 in appreciation, plus the $70,000 you’ve repaid, plus the $20,000 down payment).

Renting doesn’t work that way. The money you pay each month only goes toward covering your current living expenses. You don’t recoup the cost of those payments when your lease is up or you decide to find a new place to live.

How can I start building net worth?

The short answer—become a homeowner!

United offers mortgage products specifically aimed at helping first-time homebuyers finance a home, including loans that don’t require a down payment.

To learn about your options, connect with one of our mortgage experts today or start your application now using our secure online portal.