Mastercard® Debit Cards

The power of a community in your wallet.

Issued by your community’s most trusted bank, this debit card gives you the convenience you need, no matter where your life takes you.

Card Controls

- Understand your spending clearly with spending insights, recurring payment information, ‘card-on-file’ merchant identification, and more.

- Get real-time transaction alerts so you know exactly when and where your card is being used.

- View a digital card on a mobile device and easily push it to Apple Pay or Google Pay.

Mastercard® ID Theft Protection

- Identity Monitoring

- Financial Account Takeover Protection

- Resolution Services

- Lost Wallet Assistance

- Single-Bureau Credit Monitoring

Make room for more important stuff.

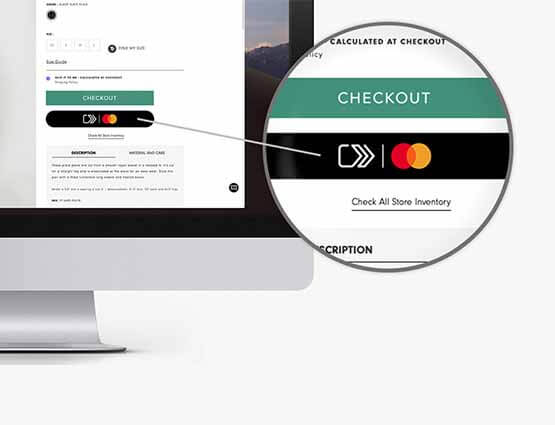

Enjoy the convenience of adding your Mastercard® debit card into your mobile wallet. With fewer cards in your pocket, you can free up space for more important things, like more money or candy.

Compatible with Google PayTM, Apple Pay®, Samsung Pay, Venmo, PayPal® and more.

Click to Pay

Frequently Asked Questions about Debit Cards

Turn your card off and on again

- Be in total control of your debit card. For example, turn your United Mastercard® debit card off with the touch of a button if your card gets lost or stolen.

Set spending limits

- Restrict your United Mastercard® debit card use by dollar amounts, specific retailers, locations and more.

Set up alerts

- With Card Controls, you can turn on alerts to get notified every time your United Mastercard® debit card is used.

If your debit card has been lost or stolen, it is important that you report it to us immediately. Immediate reporting ensures potential losses will be kept to a minimum.

During normal business hours: Call 1-800-UCBANK1 (1-800-822-2651) to speak with our Customer Contact Center.

After hours: Call 706-439-6600, then follow the prompts to be directed to the Card Center in order to report and block your lost or stolen card. You will then need to contact your local branch or call 706-439-6600 during business hours to speak with our Customer Contact Center the next business day to order a replacement card.

Card Controls: If you are using Card Controls, log into online banking or the United mobile app and set the lost card to the OFF setting, then call 706-439-6600 the following business day to order a replacement card.

You will no longer be able to use your card within Apple Pay™, Android Pay™ or any of our mobile wallet solutions, so be sure to remove the card. When you receive your new card, you will need to add the new information to the mobile wallet solution that you use.

Resources

Mastercard® Guide to Benefits for Prepaid Cardholders

Mastercard® Guide to Benefits for Enhanced Debit Mastercard Cardholders

Mastercard® Guide to Benefits for Small Business Cardholders

Learning Center

-

$1 charge on all transactions outside of the United or Publix Presto! ATM networks unless account holder qualifies for the fee to be waived. ATM transactions/balance inquiries outside of United or Publix Presto! ATM networks are also subject to charges by other institutions.

2 Message and data rates may apply. Fees may apply for certain optional services through Personal Online and Mobile Banking.

3 Certain terms, conditions and exclusions apply. Cardholders need to register for this service. This service is provided by Iris® Powered by Generali. Please see your guide to benefits for details or call 1-800-MASTERCARD