Make Buying a Home More Affordable

When interest rates rise, your home-buying budget goes down. That’s because more of your monthly payment is going toward paying interest instead of paying down the money you borrowed.

But there are ways to make homeownership more affordable so that you can buy the home of your dreams, regardless of what the market’s doing.

Strategy 1: Secure down payment assistance.

Down payment assistance programs help offset the costs that come with buying a home, like a down payment and closing costs. This assistance typically comes in the form of a grant or second mortgage and can make it possible to move forward with buying a home, even if you haven’t saved enough for a down payment.

United offers a number of down payment assistance options that can be used with a wide variety of loan programs. Down payment assistance does often come with certain requirements—for example, some programs may require you to buy a home in a specific location or hold a certain occupation.

Strategy 2: Negotiate a 2-1 buydown.2

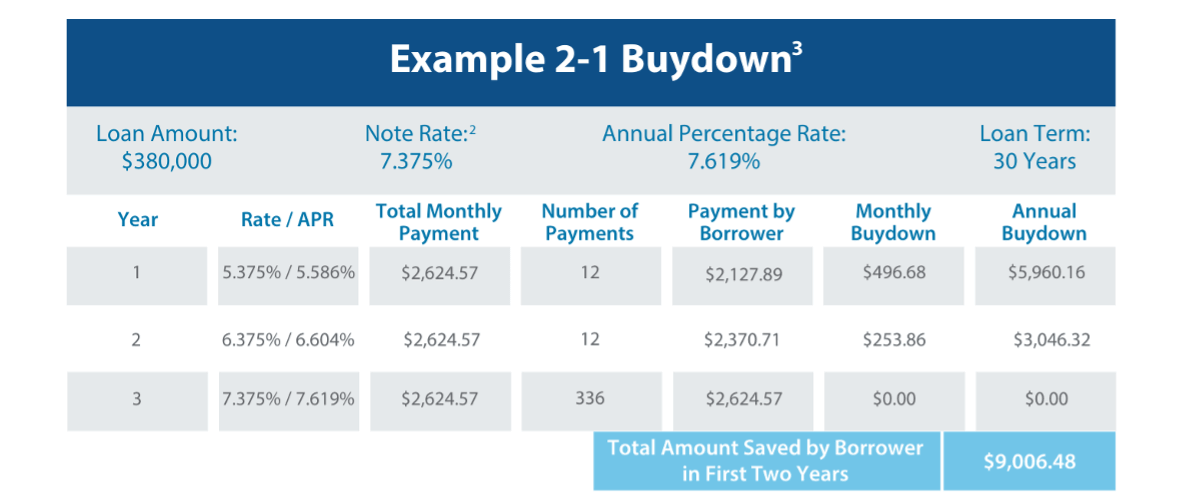

You can think of a 2-1 buydown as a way to ease into your mortgage by temporarily lowering your payment amount. In the first year of your agreement, your payment amount will be based on an interest rate that is 2% lower than the actual interest rate on your mortgage loan. In the second year, your payment amount will be based on a rate that is 1% lower than your actual note rate. Then, in the third year, your payment amount moves to your actual note rate (and stays there through the remaining term of your mortgage).

A lower monthly payment for the first two years of your loan will help you avoid some mortgage “sticker shock” and save money on interest, freeing up some extra cash each month during the first two years of the loan.

Taking advantage of a 2-1 buydown does come with a cost. But the good news is you’re not the one who covers it. The difference between the payment listed on your note and the discounted payment during the first two years of the loan is paid at closing by the seller or builder (if you’re buying a new construction home), often as an incentive to get a property sold.

Strategy 3: Opt for an extended rate lock.

Mortgage interest rates are always changing¾sometimes the rate in the morning won’t match the rate in the afternoon. And that can make it tough to set a house budget, especially if you have your eye on a new construction home. Those houses take months to build, and while you may go under contract on a property before ground is broken, you won’t actually close on the purchase until construction wraps up.

When you apply for a home loan, you’re typically given the option to lock your offered rate for anywhere from 30 to 60 days. That window gives you enough time to go through the home loan process and close on your loan before the rate lock expires.

But new construction follows a longer timeline. An extended rate lock protects your offered rate for a longer period of time than that typical 30- to 60-day lock period. United Community gives you the option to lock your rate for up to 240 days.4 That means you can confidently write your offer with a firm understanding of the monthly mortgage payment you’re committing to when you move into the home.

Plus, if rates drop, you have the option to “float down” to the market rate one time within 30 days of closing. So, no matter how the market fluctuates, you’re protected with an extended rate lock.

Strategy 4: Purchase discount points.

Discount points lower the interest rate on your mortgage. They’re fees you pay upfront at closing in exchange for that lower rate.

Each point typically costs 1% of your total loan amount and can lower your interest rate by 0.25%. So, if you have the cash and plan on staying in your home for a while, mortgage points can be a smart investment.

Determining Your Strategy

Every strategy isn’t right for every homebuyer. That’s why our team spends time getting to know you and your unique financial situation to help you understand all of the options that could help make homeownership more affordable for you.

Ready to connect with one of our mortgage experts? Contact our team or start your secure, digital application now. We’re here to help you every step of the way.

1Restrictions apply. Not all borrowers will qualify. This is not a commitment to lend.

2Borrower must qualify at the note rate. Temporary buydown does not change the term or amortization of the loan. Standard interested party contribution guidelines apply. For purchase loans only. Certain loan products and property types are ineligible. See mortgage loan originator for specific product details.

3Information provided for illustrative purposes only. Actual rate and terms will vary.

4Offer subject to change without notice. Borrower will pay an upfront application fee to lock mortgage interest rate up to 240 days out. Application fee will be shown as paid outside of closing at closing. Available for purchase of new construction only. Float down option is available within 30 days of closing, but not less than 10 calendar days before closing or expiration date of the lock.