Fraud Prevention: Card Cracking Scams

How does it work?

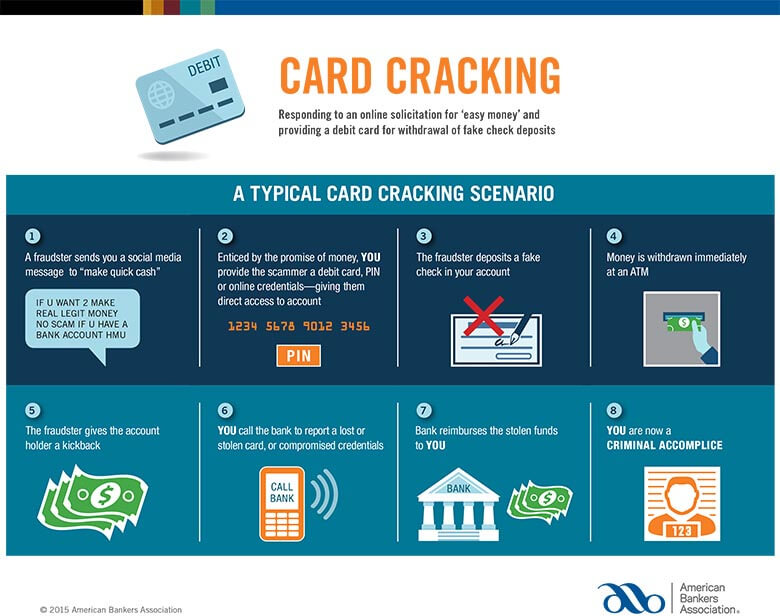

Criminals use social media platforms like Facebook, Twitter, or Instagram to solicit consumers, often targeting people between the ages of 19 and 25 years old, as well as college students, newly enlisted military, and single parents.Customers who respond to these solicitations, now accomplices, provide a debit card, PIN, and online credentials to give the criminal direct access to their account. The fraudster deposits worthless checks using mobile deposit and immediately withdraws the funds at an ATM. The customer then calls to report a stolen card or compromised credentials. The bank reimburses the customer for funds lost and the criminal provides the customer with a cut of the money withdrawn using worthless checks.

How to avoid it:

- Do not respond to online solicitations for “easy money.” Card cracking advertisements will suggest that this is a quick, safe way to earn extra cash. Keep in mind that easy money is rarely legal money.

- Never share your account and PIN number. Keep this information private at all times. By sharing it with others, you expose yourself to potential fraud.

- Do not file false fraud claims with your bank. By filing a false claim, you are a co-conspirator to fraud. Banks’ detection techniques for card cracking are constantly improving, and suspicious claims will be investigated.

- Report suspicious posts linked with scams. If you notice postings that appear to be linked with a possible scam, report them to the social media site. There is usually a drop-down menu near the post to allow for easy reporting.

To further protect yourself from scams like this one, be sure to use services from your bank like Card Controls. Card Controls allows you to turn your card on/off as you wish and set alerts, and it offers you a number of other control preferences to safeguard your debit card.

As always, if you think you’re the victim of fraud or that someone is attempting to access your personal financial information, contact us immediately. We’ll help you take the next best steps.

Source: American Bankers Association