Banking made personal.

Open an AccountConvenience

Peace of Mind

Education and Support

The First Step to Your Saving Goal

Compare your account options.

Enjoy these benefits with every account.

Online Banking

Debit Cards

Stop Payments

Overdraft Protection Services

Direct Deposits

Exclusive Discounts

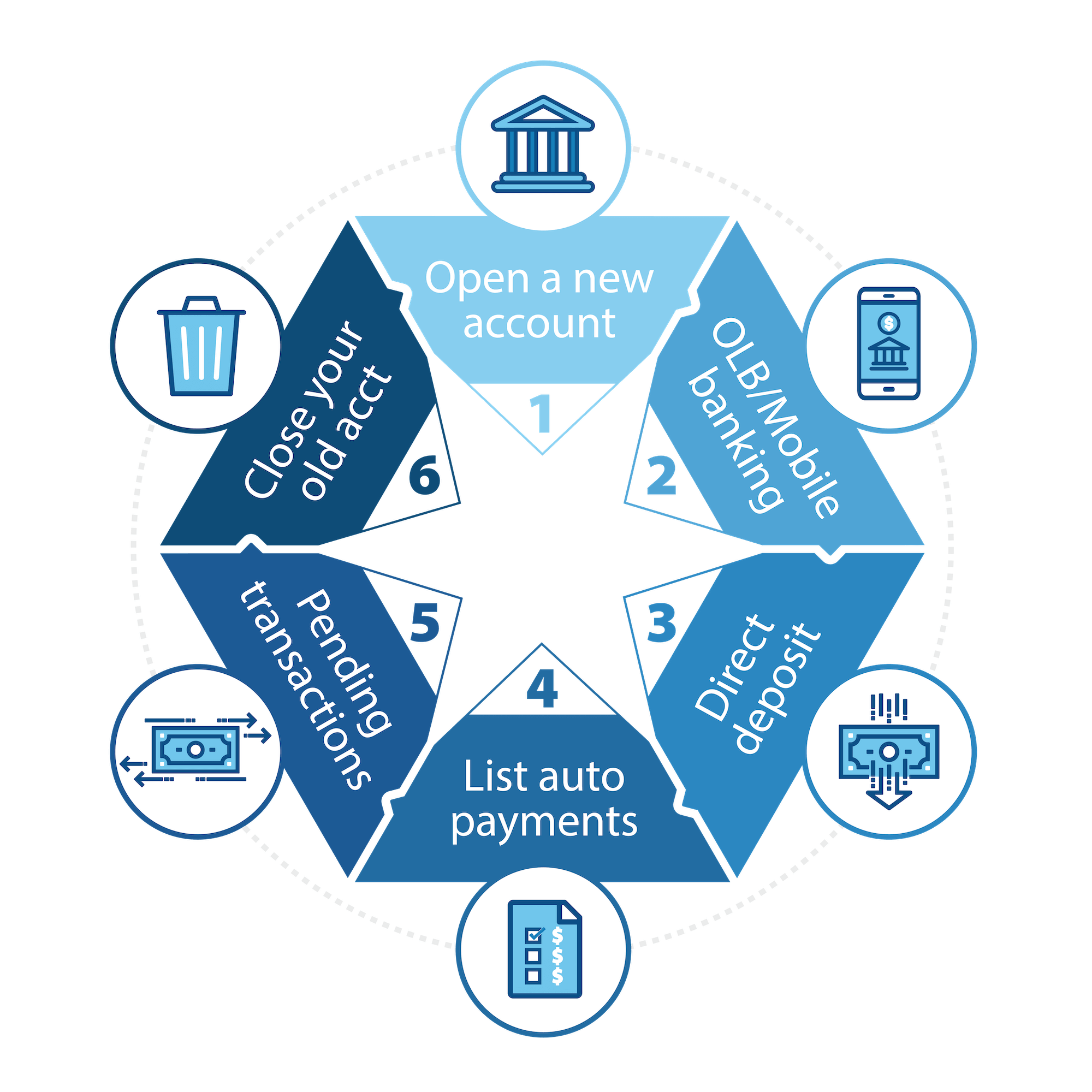

Ready to make the switch?

Open a new account

Set up your United online/mobile banking account

Set up direct deposit

List automatic payments and update payment information

Keep an eye out for pending transactions

Close your old account

-

Zelle® is a U.S.-based digital payments network that allows eligible customers to send money between you and others enrolled with Zelle®. The services referenced are provided exclusively by Zelle®. Your use of such services is solely at your election and is subject to United Community Bank’s (“United”) Online Banking Terms and Conditions and Terms of Use for Zelle®. Certain restrictions apply for use of the service.

2 Certain terms, conditions, and exclusions apply. Cardholders need to register for this service. This service is provided by Iris® Powered by Generali. Please see your guide to benefits for details or call 1-800-MASTERCARD.

3 Discount is applied to locked interest rate and will be detailed in initial disclosures and initial closing disclosures. Auto-pay discount is available for all United portfolio products except construction loan products. Discount is received through an ACH authorization form. United Community account from which the payment will be drafted must be opened and all requirements fulfilled prior to closing. Auto-pay discount will not be offered after loan is closed.

4 Eligibility auto-pay discount and reduced closing costs requires a United Community Bank checking account. Closing costs vary by state and loan amount. Bank may choose to waive a portion of the closing costs. Borrower pays all costs pertaining to recording fees, tax monitoring fees and mortgage taxes. HELOC product is available only for consumer owner-occupied, single-family residences and is not available on manufactured homes or leasehold properties. Bank must be in a valid first- or second-lien position. Property insurance and flood insurance, if applicable, are required on all collateral. The HELOC has a 10-year draw period and 15-year repayment period. Exclusions and limitations apply.